When they transfer until the age of three, a single mother. Benefits and guarantees for single mothers

At the federal level, child benefits for a single mother practically no different from payments for children raised in a two-parent family - neither according to the list of types, nor according to their size. Federal laws do not provide for special benefits that could take into account and improve the financial status of a family without a second parent. However, there is one peculiarity.

→

→

The only exception for them is monthly child benefit, which is formally federal, but its size is determined by decision of the regional leadership. For single mothers, this payment is assigned in an increased amount compared to the established basic level.

In general, child benefits for a single mother depend on the following factors:

- the fact that the mother is employed;

- number of children a woman has;

- average per capita income of a family with a single parent.

In some regions, with rare exceptions, additional targeted social benefits are also provided specifically for single women whose child does not have a father according to documents (or he is recorded on the birth certificate according to the mother).

How much does a single mother receive for child support from the state?

In general, a single mother can count on the same benefits from the state as a mother from a full family. Child benefits depend on the number of children she has, employment status and material income. Moreover, as a rule, they do not depend at all on the official single mom status.

A single mother will receive the same amount for children as a family with two parents receives. That's why there is no point in applying for single status just for the sake of the size of social benefits. The list and amount of payments at the state level is established by Federal Law No. 81-FZ of May 19, 1995 “On state benefits for citizens with children.”The only federal payment that single mothers can count on in an increased amount is simply called child benefit. It is assigned, and the amount varies depending on the region (most often, it is very modest).

Attention

Regions are also allowed to independently establish targeted or categorical payments to citizens at their own discretion. for single mothers there are additional regional benefits. A single mother should first of all find out whether in the region of her residence there are any special payments that she is entitled to.

How much does a single mother receive for her first child?

The state's care for mother and baby begins even before birth. At the state level, a single mother is entitled to payments starting from pregnancy (but only if the woman works) until she reaches 3 years of age. All benefits are divided into monthly and one-time.

Listed below benefits for the first child and their sizes, appropriate for a single mother.

- This list of social payments is relevant for officially employed woman, for which the employer pays insurance premiums, as well as soldier or student.

- Benefits are issued at the place of work, study or service, and are paid through social insurance.

Table of benefits for the first child for a single mother

| Payment name | Size, rub. | Comment |

|---|---|---|

| Maternity benefit (M&B) | 100% of a woman's average income for the period from the 30th week of pregnancy to the 70th day after birth. Minimum RUB 34,520.55 when going on maternity leave from 07/01/2016 to 06/31/2017 | Paid if the woman did not work and did not receive a salary during the BiR leave |

| One-time when registering in early pregnancy (up to 12 weeks) | 613,14 | Is an addition to the manual on B&R |

| One-time at the birth of a child | 16350,33 | Relies on both working and non-working mothers |

| Monthly allowance for child care up to 1.5 years | 40% of a woman’s average earnings, minimum RUB 3,065.69. | Those who are not working are paid, those who are working are paid at their place of work or in the Social Insurance Fund |

| Compensation payment for a child from birth to 3 years | 50,00 | Paid only during parental leave up to 3 years old |

| Child benefit under 16 (18) years of age for low-income people | Varies | The size is established by regional legislation. Paid at least once a quarter |

Amount of benefits for a single mother with two or more children

An employed single mother who has a second newborn can count on the same payments as after. They are awarded after birth every child. However, the minimum amount of monthly social benefits for caring for a second child up to 1.5 years old is increasing and a single mother has the right to maternity capital.

Table of additional benefits for a single mother for her second child

In the case of a single woman third baby, she is also guaranteed the following benefits:

- Monthly payment for the third child— valid in 69 regions of the Russian Federation, paid for up to 3 years only to low-income families for the third or subsequent child in the amount of the children's regional subsistence level.

- Regional maternity capital — in most constituent entities of the Russian Federation, it is relied upon precisely after the birth of the 3rd child in the family, however, there are exceptions.

What payments are due to a non-working single mother?

As practice shows, single mothers very often do not work before pregnancy and childbirth. Such women are entitled to less child benefits than employed mothers. All payments in this case:

- accrued in a minimum or established fixed amount;

- are paid through the social security authorities (and not through the Social Insurance Fund, like for workers).

Other benefits that stay-at-home moms can count on:

- child benefit for the poor (monthly or quarterly - the amount is set at the regional level;

- maternity capital for the 2nd baby from the state in the amount of RUB 453,026.00. — the certificate is issued regardless of employment;

- regional maternity capital for the 3rd child (size varies);

- monthly payment for the 3rd child under 3 years old in case of low income.

Formally, female students, students and military personnel are also not considered to be working, but they are still entitled to maternity benefits in a fixed amount(equal to the amount of the scholarship or allowance).

One-time benefit for the birth of a child

The fact of payment of this benefit and its amount does not depend on any external conditions and factors (security, salary, presence of a job or husband). The state guaranteed payment in the amount RUB 16,350.33(as of 2017) to the mother of every child born in the Russian Federation.For the birth of two or more children at one time (twins, triplets, etc.), a lump sum benefit is due for each of them. A woman must apply for payment within six months after the baby is born.

- Since this benefit is formally due to any of the child’s parents, to apply for it in a full-fledged family, it is necessary to provide at the place of receipt a certificate stating that the second parent did not receive this payment (and if one of them works, then only the working parent can receive the payment).

- In this regard, the procedure for processing payments for a single mother is somewhat simplified: for a single mother no need to provide at the place where you received a certificate from the second parent.

Obtaining such a certificate can be significantly complicated if the child officially has a father, but they do not live together with their mother and are generally on bad terms. Then obtaining the coveted certificate can be significantly complicated due to the reluctance of the second spouse to provide it.

Child care benefit up to 1.5 years in 2019

Unemployed single mothers will be able to receive a monthly care allowance in a minimum amount, namely:

- RUB 3,065.69 - for the first baby;

- 6131.37 rub. - on the second and every next one.

Attention

Moreover, if they receive unemployment benefits, they will be able to choose only one of the payments - unemployment from the SZN or care. Both types of social assistance are not assigned at the same time!

As you can see, non-working women are at a disadvantage compared to working women. Indeed, if employed, they could count not only on a minimum wage of up to 1.5 years, but also on the following list of payments:

- One-time allowance for BiR in the amount of 100% of the salary and payment of 613.14 rubles. when registering a pregnant woman up to 12 weeks;

- Monthly care allowance up to 1.5 years in the amount of 40% of the salary (which is higher than the minimum amount if the average earnings exceed the minimum wage);

- Compensation in the amount of 50 rubles. until the child’s 3rd birthday - it is paid by the employer and formally should compensate the woman for the temporary inability to earn money (although this has not been done for a long time due to its insignificant size).

Benefits for low-income single mothers

Due to the fact that single mothers often do not have official work before giving birth, as well as for other reasons, they are often poor. Such women are entitled to two additional benefits. They are paid regardless of the woman’s employment, but taking into account need criterion.

Table of benefits for low-income single mothers

| Title of the manual | Regulatory document | For which child of a single mother is paid | Size | Reasons for receiving |

|---|---|---|---|---|

| Per child (monthly, quarterly) | Art. 16 of Law No. 81-FZ of May 19, 1995; regional legislative acts |

For everyone up to 16 (18) years old | Set regionally | If the average per capita income per family member is below the regional subsistence level (LM) |

| For the third and next baby | Decree of the President of the Russian Federation No. 606 of 05/07/2012, regional documents | For the 3rd and each subsequent child under 3 years of age born after 01/01/2013 | The amount of children's PM for the quarter in which the appeal occurred | The average per capita income is below the established amount for the region. Paid only for children with Russian citizenship |

Amounts of both payments depend on the region of residence women and are established according to regional laws.

Attention

It is worth submitting documents on income for months that did not include the month of receiving a one-time benefit under the BiR. Otherwise, incomes may be overestimated, and benefits for the poor will not be provided.

- The first benefit exists in every region of the Russian Federation regardless of the order of birth of the child. If the need criterion is met, single mothers are paid an increased amount compared to the regular amount (usually one and a half, two or three times).

- It is worth recalling that a single mother is legally considered a woman in relation to a child whose birth documents indicate father not specified(or indicated from her words), and a joint statement of paternity was not submitted to the registry office.

- If a woman just divorced from her husband(also if a widow or if the child’s father is deprived of parental rights), she is not considered a single mother, and she will be entitled to benefits at the usual rate.

- The second benefit in 2017 is valid only in 50 constituent entities of the Russian Federation and only for the 3rd child (and subsequent children). The list of regions for which the payment is relevant is adjusted annually.

- These benefits are issued at the local social protection authority. Documents can also be submitted through the MFC.

- It makes sense to apply for them while the baby less than 6 months old, since it will not be possible to return the unpaid amount within a longer period.

Mandatory benefits for low-income single women for each child are valid in all regions of the Russian Federation. It is established at the state level, but the size is regulated regionally. Usually it does not exceed 500 rubles, although there are exceptions. For example, it amounts to for each child of a single mother:

- in the Tver region, Izhevsk and Udmurtia - 362-368 rubles;

- in the Ivanovo region. — 472 rub.;

- in the Belgorod region. — 540 rub.

- in the Oryol region. — 540.94 rub. (for the first) and 676.18 rubles. (second and subsequent);

- in Sevastopol and Crimea - 1596 rubles;

- in St. Petersburg - 3,298 rubles. and 3,768 rub. (for the first and second up to 1.5 years), 848 rubles. (1.5-7 years), 787 rub. (7-16 years old).

The amount of benefit for a third child under 3 years old also varies greatly between regions. For example, as of the 2nd quarter of 2016, in the Belgorod region, a single mother for her 3rd child will receive 8,150 rubles, and in the Nenets Autonomous Okrug - 21,076 rubles.

How much do single mothers get paid in the regions?

Also in the regions (not all) there are different additional payments single mothers.

- To receive special payments, a woman must submit to social security the necessary package of documents, which includes F-25 certificate, confirming the status of a single mother.

- Permanent residence in the specified region is required.

Attention

The list and amounts of benefits intended specifically for this category of the population are regulated by local legislation. Even for neighboring regions of the Russian Federation it may differ significantly.

Examples of regional payments to single mothers

| Region name | What benefits are provided? | Size in 2017 | Conditions of receipt |

|---|---|---|---|

| Moscow | One-time “Luzhkov payment” |

5 sizes of PM per capita (75,460 rubles for the 4th quarter of 2016) - for the first child; 7 sizes PM (RUB 105,644) - on the 2nd; |

|

| Tomsk region | Annual school preparation allowance for low-income people | 1,000 rub. | If a single woman has two or more children. Resolution No. 96a of December 28, 2004 |

| Sakhalin region | Monthly social benefit for a child 1.5-6.5 years old who does not attend kindergarten | 9,500 rub. | Only low-income people. Law No. 144-ZO of December 27, 2011 Payment is not assigned starting from January 1, 2016 |

This table shows only payments established by local law. The monthly child benefit for the poor, which is mandatory for all regions, was not indicated. Single mothers are also entitled to all the social benefits that a full family can count on in the region.

Attention

If a single mother marries but her husband does not adopt the child, the woman may still be entitled to special single mother benefits for that particular child. When calculating income, the husband's salary will not be taken into account. However, this should be clarified in advance with the social security authorities.

Payments upon adoption of a child by one parent

The law does not prohibit adoption by a single woman or man (that is, a person who is not officially married). In this case, the child only appears one (sole) adoptive parent. The child can be of any age, but the requirements for a minimum age difference and other factors taken into account during adoption must be met.

Depending on whether the woman who wants to adopt a child works and in which region of the Russian Federation she lives, she will be entitled to all relevant federal and regional payments. Their list can be adjusted if the adoptive parent gets married and his partner also adopts the child.

Single employed adoptive parent The following benefits are provided:

It must be remembered that according to Russian law, adopted children equal in rights to relatives. A single adoptive parent can count on the same benefits as if the adopted child were his own.

RedRocketMedia

Bryansk, Ulyanova street, building 4, office 414

As a rule, a single mother is recognized as a woman who gave birth to a child outside of marriage, provided that there is no entry about the father in the birth certificate or it was made according to her words. Benefits and allowances for this category of persons are established by both federal and regional legislation.

A woman who has adopted a child out of wedlock (single adoptive parent) can also be recognized as a single mother.

The Labor Code mentions single mothers, but there is no definition for this category of persons. However, the Supreme Court gave its clarification on this issue. Resolution of the Plenum of the Armed Forces of the Russian Federation dated January 28, 2014 No. 1 explains that, within the framework of labor legislation, a single mother is considered woman raising children without a father which, in honesty:

- died;

- cannot personally raise a child due to health reasons;

- deprived of parental rights or limited in them;

- declared missing;

- declared incompetent (partially capable);

- is serving a sentence in a colony or prison;

- avoids raising children or protecting their rights and interests.

In the Tax Code there is a concept single parent. According to the letter of the Tax Department of the Ministry of Finance dated October 30, 2018 No. 03-04-05/78050, this means that the child does not have a second parent, because he, among other things:

- died;

- declared dead by the court;

- went missing.

Regional legislation may contain similar concepts that both coincide with the definitions above and complement them. For example, in Art. 2 of the Social Code of St. Petersburg establishes the term single-parent family- a family in which one of the parents:

- a single parent raising one or more minors;

- has the status of a single mother or father;

- second parent:

- died;

- declared dead or missing by a court;

- deprived or limited in parental rights;

- doesn't pay child support.

Benefits for single mothers in 2020 from the state

Since the status of single mothers is not fixed in federal legislation, almost no separate government benefits and payments are provided for them, but there are several exceptions:

In addition, a single mother has the right to:

In the event of the death of a spouse, a woman who has become a single mother can count on:

- a survivor's pension if she cannot work because she is busy caring for children under 14 years of age (clause 2, part 2, article 10 of Federal Law No. 400-FZ of December 28, 2013);

- free legal assistance if the husband died due to an emergency - flood, earthquake, etc. (clause 8.1 of article 20 of the Federal Law of November 21, 2011 No. 324-FZ).

Personal income tax deduction for children for a working mother

A single mother can apply for a double tax deduction for a child (paragraph 12, paragraph 4, paragraph 1, article 218 of the Tax Code). It can be received in the form of exemption from personal income tax or a refund of overpaid tax.

In the first case, you need to provide the employer with:

- application for a double deduction (see);

- birth (adoption) certificates of children;

- a document proving that the children do not have a father:

- - information about the father is recorded from the words of the mother;

- death certificate - the father died or was declared dead;

- extract from the court decision - the father was declared missing;

- passport;

- a certificate from an educational institution - for students over 18 and under 24 years old;

- certificate of disability of the child - if available.

You can return tax for the previous year to the tax office (i.e., not through your employer). To do this, you must submit the same documents and, in addition to them, a 2-NDFL certificate and a 3-NDFL declaration from January 1 to April 30. The maximum income for which a deduction is provided is 350,000 rubles per year, that is, after the total amount of earnings reaches this mark, it will not be possible to issue a deduction.

The employer is obliged to establish part-time working hours for a single mother with children under 14 years of age or disabled children under 18 years of age at her request, but no more than for the period of existence of circumstances due to which the employee needs part-time work (Article 93 of the Labor Code RF). Parents with a disabled child are given, upon their written application, 4 additional days off per month, paying for them an amount equal to the average earnings (Article 262 of the Labor Code of the Russian Federation).

For single mothers with a child under 14 years old, for mothers with two children under 14 or with a disabled minor child, additional leave of up to 14 days without pay may be provided; for this it must be specified in the collective agreement (Article 263 of the Labor Code of the Russian Federation) .

Sick leave for child care

If there is a single mother caring for a sick child, then she also receives temporary disability benefits on a general basis according to the law of December 29, 2006 No. 255-FZ.

According to Part 5 of Art. 6 of this law, benefits are paid depending on the age of the child:

- - the entire period of outpatient (at home with a visit to a clinic or hospital) or inpatient treatment, but not more than 60 calendar days per year (90 in certain cases)

- 7-15 years - up to 15 calendar days for outpatient or inpatient treatment, up to 45 days per year;

- up to 18 years old:

- disabled child - the entire period of treatment at home or in hospital, no more than 120 days a year;

- post-vaccination complication - the entire period of treatment;

- a child infected with HIV - the entire period of inpatient treatment.

In case of inpatient treatment of a child, the benefit is paid for the time the mother and child are together in the medical institution.

According to Part 3 of Art. 7 of the law, depends on the mother’s work experience and her salary:

- for the first 10 days of outpatient treatment and the entire period of inpatient treatment:

- up to 5 years of experience - 60% of the average salary;

- 5-8 years of experience - 80% salary;

- 8 years of experience - 100% salary;

- for the 11th and subsequent days of treatment at home - 50% of the salary, regardless of length of service.

Sick leave is not issued if:

- caring for a child over 15 years of age during inpatient treatment;

- caring for a chronic patient during remission;

- during vacation - annual, at your own expense, for pregnancy and childbirth, caring for a child under 3 years old, except in cases where a woman works part-time or at home during this period.

Can a single mother get an apartment from the state?

Federal laws do not establish housing benefits for single mothers, so they can receive them if they are recognized as in need of housing on a general basis. For this, according to Art. 51 of the Housing Code, the family must meet at least one of the conditions:

- it does not rent housing under a social tenancy agreement or a lease agreement for social housing premises, its members do not own residential premises;

- in residential premises provided under a social rental agreement, an agreement for the rental of social housing space, or in premises that are owned, each family member has less than the accounting norm in the region;

- the house or apartment does not meet the requirements of residential premises;

- another family lives in the same premises with a chronically ill person, with whom it is impossible to live together (the list of such diseases was approved by Order of the Ministry of Health dated November 29, 2012 No. 987n).

A single mother recognized as needing housing can receive an apartment under a social tenancy agreement, the size of which is determined by the provision rate - it may be larger than the registration amount: in Yekaterinburg - 16 sq. m. m, in Moscow - 18 sq. m, in Volgograd - 14 sq. m.

A single mother under 35 years of age can also, on a general basis, receive a subsidy for the purchase of an apartment under the “Young Family” program. Its size is determined based on the estimated cost of living space:

RS = N × RV,

- RS - estimated cost;

- N - standard cost of 1 sq. m of housing, established by local governments;

- RZ - living space area, set in the amount:

- 42 sq. m - for a single mother with one child;

- 18 sq. m per person - for families of 3 or more people.

The subsidy will cover 35% of the cost of housing, and it can be used for:

- payment under a purchase and sale agreement, equity participation or construction contract;

- down payment, debt payment and interest on a home loan;

- making the first or last share contribution to a housing cooperative.

Regional payments and benefits for single mothers

In the regions, low-income families are paid benefits for children up to 16 (18) years of age, and in most cases single mothers receive it in an increased amount - usually twice as much (but this procedure does not apply everywhere). Some regions may also introduce additional benefits and payments for certain categories, including single mothers.

All benefits and benefits below are regional, and they are established by the laws of the relevant subjects of the federation. To find out whether such payments are available in your region, contact the social security authorities at your place of residence.

For example, in the Samara region and Mordovia, a single mother can receive:

- annual payment in honor of Easter;

- allowance at the beginning of the school year - for single mothers of three children (in Mordovia also - for mothers of two children with incomes less than the subsistence level).

In the Irkutsk region, single parents have the right to:

- advantage when admitting a child to kindergarten;

- free prescription medications for children under 3 years of age;

- payments and social scholarships to students of state loans.

In the Ulyanovsk region, for single mothers with children from one and a half to 3 years old and an income less than the regional subsistence level per capita, the following applies:

- compensation for non-attendance at a kindergarten if a place could not be found or the child cannot attend the kindergarten for health reasons - in the amount of the average parental fee depending on the region and the time the child spent in the kindergarten, approved by Resolution of the Regional Government dated December 18, 2013 No. 609- P (from 7.4 to 135 rubles per day);

- social support for the family until the child is 3 years old.

In the Tula region, they pay a monthly allowance for single mothers who are raising a disabled child - 1,200 rubles for each.

In the Penza region, compensation for renting housing has been introduced for single mothers with children, one of whom is under three years old:

Targeted benefits for families in need

If the income of a single mother’s family, divided among all family members, is less than a certain level, then on a general basis she has the right to additional payments established for low-income citizens. As a rule, the criterion of need for these benefits is the subsistence minimum (LM), sometimes 1.5 or even 2 LM.

- for the first and second child. In 2019, they are paid for children under 1.5 years of age to families with incomes below 1.5 monthly subsistence minimum for the working-age population, established in the region for the 2nd quarter of the previous year (from 2020 - until the child reaches 3 years of age and with incomes up to 2 subsistence minimum).

- . Part 2 of Presidential Decree No. 606 of 05/07/2012 recommended that regional authorities establish such payments for children born after December 31, 2012. Now they exist in 65 regions, according to the list approved by Government Order No. 1747-r dated August 24, 2018. As a rule, the size of the payment is equal to the child's monthly minimum wage in the region: from 8 thousand rubles in the Belgorod region to 21 thousand in the Nenets Autonomous Okrug. But in some regions, the amount of the benefit is not tied to the monthly minimum: in the Orenburg region - 5398 rubles, in the Samara region - 10565.

- Subsidies for housing and utilities, which can be received by families who spend more than a certain part of their income on them, at the federal level - 22%, but regions can lower this value: in the Kursk region, depending on the average per capita income - 10% (less than 1000 rubles ), 13% (1000-1500), 16% (less than PM) or 22% (more than PM), in St. Petersburg - 14%.

- , established by the legislation of the constituent entities of the Russian Federation - for food, clothing and footwear, for preparation for school, the purchase of school and sports uniforms, etc. For example, in the Vologda region they pay 3,000 rubles for each first-grader, and in the Chelyabinsk region, students under 18 years old can ride public transport for free with a transport card.

The exact list of benefits varies by region and can be found at your local social security office.

The work of a single mother cannot be expressed in monetary terms: carrying a baby, giving birth, raising her, giving her the opportunity to study at school and university. Each item requires not only physical, but also material costs. The support provided by the state is not always commensurate with reality, but it is good that it is present at all. Every year the amount of payments for children is subject to indexation. What amount of benefits will be available to single mothers in 2016 and should we hope for an increase?

What kind of assistance is provided at the state level?

Despite the great interest of government officials in supporting the institution of the family at the state level, single mothers do not have great privileges, and the budget is not allocated for this. Single parents are entitled to the same financial support as all two-parent families.

to contentsWhat's a working woman supposed to do?

Every mother who is officially employed has the right to transfer maternity money if she is registered before the end of her pregnancy at 3 months. Issue is made by the accounting department of the enterprise after providing sick leave, which is received at the antenatal clinic after a period of 30 weeks. It is necessary to attach an application for the issuance of money, and after the birth a lump sum payment will be transferred.

The amount is calculated from the average salary for the last 2 years of work, but it cannot be lower than the minimum wage, which for 2016 is 6204 rubles. The amount of benefits for single mothers in 2016, calculated taking into account the minimum wage and paid in a lump sum, is 33,089.10 rubles. There is also a maximum limit - 248,164 rubles.

When considering the question of what benefits single mothers receive after childbirth, it should be noted that accruals are due to all women who are employed, as well as the unemployed. The amount is 14497.80 rubles. In 2016, indexation will be carried out by 5%. The money is received from the organization’s accounting department, for which you need to bring a birth certificate, which does not contain information about the father. In order to receive this money, two-parent families submit a certificate from the place of employment of the second parent confirming the non-receipt of these funds. That is, the transfer occurs only to one parent.

Until the child reaches the age of one and a half years, a child care allowance is accrued to a single mother, as well as to all families. The amount receivable is calculated at 40% of the employee’s earnings at the enterprise, which must not be lower than the minimum wage, but not higher than 19,855 rubles. Women raising several children have the opportunity to sum up the funds intended for each one separately.

to contentsWhat can mothers without work expect?

With official employment, the size of the benefit for a single mother will be much more noticeable for her wallet. The state does not ignore those women who find themselves with a child in their arms without the help of a father, as well as without work. True, they are entitled to a minimum amount of money at the federal level. To receive bonuses, you should contact social security to find out whether they are provided in the area of residence.

The amount of maternity benefit for a single mother is not given to everyone, but only to those who are forced to remain unemployed. There is a very short list of such situations in which 543.67 rubles are due. Students studying at an educational institution receive funds in the form of a scholarship.

The child benefit for a single mother who does not work is set at:

- 2718.34 rub. - per minor;

- RUB 5,436.67 - for two or more. Indexation in 2016 will be approximately 4%.

There is an exception according to which a non-working mother can receive 40% of her previous income in the event of dismissal and while on vacation. True, this is only possible if the organization is liquidated. Otherwise, the employer may suffer losses in the form of a fine for such an action.

From one and a half to three years of age, federal assistance is awarded to all parents in the amount of 50 rubles. The benefit for a single mother in 2016 will be the same amount.

to contentsWhat documents need to be submitted

According to the law, a single mother is considered to be a mother who gave birth to a child without a father and whose details are not indicated on the birth certificate. You can often find a record about the father, which was made verbally, but this is not advisable. The presence of such a record obliges the mother to submit additional documents in each exceptional case. For example, if you want to cross the border with a minor at customs, you must have the father’s consent to leave.

Working mothers receive all kinds of additional funds from the company's cash register. Unemployed people apply to social security at their place of residence.

List of documents for accounting:

- Statement.

- Mother's passport.

- Child's birth certificate (without record of father).

- Certificate of father's record from the mother's words (if there is such a record).

For social protection, this list will be expanded with the following documents:

- Work book.

- A certificate from the Central Tax Office stating that the mother is not registered with them.

- Certificate of family composition.

- Bank details for transfer.

What additional payments do the regions make?

Since the federal budget is not able to fully provide for single mothers, this responsibility falls on local authorities in the regions. By their orders, they can increase all subsidies by 2-3 times or set a fixed amount. Content levels may vary significantly in different regions. Below is information about some regional supplements, but you should contact Social Security for exact details.

to contentsOne-time payment of money

Many entities establish this type of assistance as a one-time transfer of funds after childbirth. For example, in Moscow, if the mother is no more than 30 years old, there are “Luzhkov” payments:

- five times the subsistence level is paid per child;

- for two - seven times;

- for three or more - tenfold.

To receive this money, Moscow registration is required.

In the Krasnodar Territory, 100 thousand rubles are paid to large families. There is an order according to which large families in Russia are required to be provided with plots of land. In each subject, you should separately find out about the conditions for obtaining it and the exact sizes. For example, in Kuban they provide a plot of land not for ownership, but for rent and without the right to resell. There are special conditions for further acquisition of land ownership.

to contentsMonthly allowance

When determining a family's standard of living below average, a monthly allowance is provided to single mothers living in Moscow:

- 2500 rub. (up to one and a half years, as well as from three to 18);

- 4500 rub. (from one and a half to three).

The same category of citizens is entitled to monthly funds in the amount of 750 rubles. (up to 18 years), as compensation for improving the standard of living, and another 675 rubles. (from one and a half to three) as compensation for the high cost of products.

In the Krasnodar Territory, the monthly benefit for single mothers in 2016 will be:

- 152 rub. - for one baby;

- 220 rub. - for two;

- 298 rub. - for three or more.

Most single mothers receive this maintenance until their children reach adulthood. But the status of a single mother must be confirmed with social security every year. In different regions of the country, monthly assistance can vary from 50 to 3,000 rubles.

In the regions, additional subsidies are provided for children under three years of age

Most regions of the country have a program that provides additional assistance to families with more than three children. The allowance for a single mother with many children will be accrued like everyone else. On average, between 6,000 and 11,000 rubles are subject to monthly transfer, depending on the standard of living in a particular region.

If a woman decides to formally enter into a union with a man, then the right to receive financial assistance will remain. If the husband decides to adopt a minor, this right will cease. Single mothers have many privileges at work when paying salaries, going on vacation or being invited to travel. Social benefits are also varied, but it is important to be aware of your rights and seek help in time.

A woman who, due to circumstances or of her own free will, decided to raise a child alone has the right to count on additional social and financial support from the state. What benefits are available to a single mother in 2020? More on this later.

Who is a single mother?

In modern Russia, women raising children without the participation of a father are no longer a rarity - they account for at least 30% of families. However, not every woman is considered a single mother by law, since this concept has a strict definition. Hence the conflicts that arise due to a misunderstanding of the meaning of this status.

So who is eligible for single mother benefits in 2020?

There is no legal definition of “single mother” or “single mother”. To be officially recognized as a single mother, you must meet the following requirements:

- Be divorced from your spouse for more than 300 days or not have a husband at all.

- Do not have a written document from the father indicating his relationship with the child.

- Do not have a court opinion on the fact of paternity.

In other words, only a woman whose children were born outside of a marriage union is considered a single mother, and the “father” column is empty in the birth documents. In such cases, the civil registry office employees registering the child issue the mother a certificate in a special form 25, confirming her single status.

If a baby is born in an official marriage, his mother can officially become “single” only by a court decision that has established the fact that there is no relationship between the woman’s husband and her baby. Thus, the child's father does not need to be officially identified.

Let us list the situations when society mistakenly considers a woman a single mother:

Let us list the situations when society mistakenly considers a woman a single mother:

- The couple divorced, after which the ex-woman does not receive alimony from her ex-husband and raises their common children alone.

- The child was born out of wedlock, but less than 300 days have passed since the divorce or death of the spouse. In such situations, the former spouse will be legally recognized as the father of the child, even if he has no biological relationship with the baby.

- The baby's parents are not officially spouses, but the man does not abandon the child and officially recognizes his paternity.

- Dad has been deprived of parental rights.

When a woman is legally recognized as a single mother, the mother receives the right to social and labor privileges from the state.

If you have any doubts about your rights to benefits and additional financial support, you should contact the social security authorities at your place of registration. Also, these and other issues related to divorce and maternity can be resolved by a qualified lawyer.

Benefits and other forms of support for single mothers

A woman who has received the official status of a single mother applies for federal and local support in the form of payments and benefits.

Social support

Single mothers are entitled to the same benefits as parents of two-parent families. They can count on federal benefits valid throughout the country and regional payments. They can be divided into

- Targeted assistance (for students, for the purchase of food, school uniforms);

- Low-income single mothers are usually given a larger allowance.

A single mother of a child may qualify for the following forms of social support:

- Compensation for the price of baby food for a child under 36 months of age.

- Compensation for increased cost of living

- Natural help for mothers with children under 3 years old - free envelopes for newborns, sets of linen and clothes for babies, milk kitchens for children up to 24 months, essential medicines.

- Housing benefits - discounts on utilities.

- Benefits for education.

- Preferential physiotherapy (massage) at the district clinic.

- Free meals at least 2 times a day in the school cafeteria.

- Preferential queue for admission to a preschool educational institution (DOU).

- Discounts on educational, educational and other services at preschool educational institutions.

- The right to participate in the Housing program.

- Annual treatment of a child in a sanatorium-resort dispensary.

The above benefits may vary depending on the region where the single mother lives. And the status of a single mother alone is often not enough to obtain them. Benefits vary depending on the concomitant status of the family: low-income people in need of improved housing conditions, a family raising a disabled child, etc. But in some regions, single mothers, regardless of other preferential statuses, may be granted the above-mentioned privileges.

Do you need information on this issue? and our lawyers will contact you shortly.

Labor privileges

There are specific privileges that an employed single mother is provided with:

- Staff reductions often occur at enterprises. A mother raising children alone is free from the risk of being fired until each of her children turns 14 years old. An employer does not have the legal right to fire an employee, even if she is unsuitable for the position. A single mother can be fired only if she maliciously evades her job duties and regularly commits misconduct.

- A woman is laid off during the liquidation of an enterprise. In such a situation, the manager will have to independently take care of the single mother’s new place of work.

- A single mother has the right to extraordinary leave. The period of additional rest should not exceed 14 days. In this case, the salary is not saved, but they cannot refuse to provide a woman with rest - she herself decides what time for vacation it is convenient for her to get. Such leave must be established by collective agreement.

- Before the child turns 5 years old, a woman should not work night shifts, overtime, or on weekends and holidays. Of course, if a single mother does not object to such working conditions, the employer will not break the law. In such cases, the woman must provide written consent.

- The mother is required to provide sick leave if the child gets sick. During inpatient treatment of a baby, a woman is entitled to an additional benefit, the amount of which depends on her length of service. The amount of payments is made in the amount of 100% for the first 2 weeks of sick leave, the subsequent ones are 50% of the woman’s salary, depending on the woman’s length of service. For outpatient treatment, length of service is not taken into account.

- Until the child turns 14 years old, his mother has the right to work on a reduced working day.

- If a woman gets a job, the manager cannot refuse to give her a position because of her status as a single mother. A refusal to provide a job must be accompanied by a written explanation of the reason for the refusal. Otherwise, the woman can file a complaint with the social security authorities.

Payments and benefits

The status of a single mother does not deprive a woman of the usual benefits intended for all mothers who have given birth:

The status of a single mother does not deprive a woman of the usual benefits intended for all mothers who have given birth:

- Sickness benefit for pregnancy and childbirth (B&B) - in the amount of 100% of the average salary for the last 2 calendar years (for officially employed women);

- Additional disability benefits under BiR, if sick leave was extended due to difficult childbirth - an additional paid 16 days.

- One-time benefit paid after childbirth - 17,479.73 rubles. + regional coefficient.

- up to 18 months - an allowance from the employer equal to 40% of the salary (unemployed single mothers receive financial compensation from the Central Employment Service: for one child - in the amount of 3277.45 rubles, for two or more - 6554.89 rubles).

- One-time payment to women who registered under the BiR before 12 weeks - 655.49 rubles.

In addition to these payments, a single mother can count on additional benefits provided from state and regional budgets:

- (low-income) - depends on the region.

- Additional payments for the third and subsequent children aged 36 months (low-income) are equal to the child's subsistence level in the region.

- Compensation benefit for a woman caring for a child independently. Paid only until the child turns 3 years old - 50 rubles. per month (if there is one child).

- Payments from maternity capital in the amount of the subsistence minimum for a child up to 1.5 years old.

Documents for processing payments

To apply for benefits and additional benefits, the mother should collect a package of the following documents:

To apply for benefits and additional benefits, the mother should collect a package of the following documents:

- Application for benefits.

- Baby's birth certificate.

- Certificate of cohabitation of mother and child.

- Other documents, depending on the benefit that the single mother is applying for.

A certificate of joint residence can be obtained at the passport office at the place of registration. All necessary documents should be submitted to the social protection department or MFC. The task of social protection employees is to check the specified information, visit the family in person, and, based on the data received, draw up acts on the cohabitation of the applicant and the child.

As soon as the application for payment of benefits is accepted by the social security authorities, accrual begins to occur. Payments are made until the child reaches adulthood. In some cases, benefits may be paid only for up to three years.

If a mother and baby live in a place other than their place of registration, the woman will have to take a certificate from the social security authorities regarding registration. The certificate must indicate that the single mother does not receive any payments at the place of registration. Then the benefit will be paid at the place of residence.

If a woman is employed, then part of the benefits should be arranged with the employer. The benefit paid from Maternity Capital funds is assigned by the Pension Fund.

A woman who cares for and raises children without the participation of his father or due to the absence of one is recognized as a single mother. At the state level, such a woman is not entitled to separate support, but she has the right to use all types of subsidies entitled to other mothers. Let's consider how much benefits a single mother is entitled to in 2017, their sizes and conditions for receiving them.

Benefits for single mothers for childbirth

If a woman is employed, already in the first stages you can ask your employer for a small amount for pregnancy. To do this you should proceed in this order:

- Visit a antenatal clinic or medical facility.

- Find out the gestational age. If it is less than 12 weeks, you can continue processing.

- Receive a certificate indicating the relevant characteristics.

- Submit the received document to the accounting department.

- Receive transfer.

According to the law, in 2017 the amount of the subsidy is 581.73 rubles. The amount is insignificant, but if you wish, you can count on it.

Benefit for a single mother during childbirth

A more substantial benefit for single mothers in 2017, the amount of which depends on the salary, is issued upon childbirth. When an employee goes on leave due to maternity (childbirth), the employer is obliged to treat it as regular sick leave. In view of this, he pays it in the amount of his mother’s salary.

Read interesting material about the birth certificate in our article at the link.

The calculation is made in more detail according to the following criteria:

- All the employee’s income is summed up: salary, bonuses, incl. unscheduled, disability payments, compensation for advanced training.

- Information is taken for 24 months.

- The total size is divided by 730.

- The resulting value is multiplied by 30.4.

Amount of benefits for single mothers in 2017

The calculated average amount is payable in favor of the employee, and the prerequisite is a certificate of incapacity for work (sick leave). Maternity leave is 140 days (by law). If complications arise during childbirth, it is permissible to extend it for another 16 days. If the mother gave birth to twins or more children, the leave from the date of birth is 110 days. Payment is due for the entire period. If the month is incomplete, the average daily rate is determined from the average salary and multiplied by the number of vacation days.

If the employee’s salary is small, the state has provided limits below which she will not receive - 28,555 thousand rubles. If the birth took place with complications, the amount will be 31,818 thousand rubles, if twins or more were born - 39,569 thousand rubles. The maximum for these subsidies is also limited - 248, 276 and 343 thousand rubles, respectively.

A woman who does not work cannot receive these payments, because... payment is made by the employer at the expense of social payments previously paid to the budget from the employee’s salary. Only a student will receive a subsidy in the amount of her scholarship if she is a full-time student. The specialization and level of the educational institution in this case does not matter.

Registration of state assistance for birth

After the birth of the baby, each mother is given one-time assistance from the state. It is paid for by the company for those who work, and for the rest - by the social body protecting the population. The amount of benefit for a single mother increased in 2017 and is 15,512 rubles.

For registration you will need supporting documents:

- passport;

- data on the birth of the baby from the registry office (certificate);

- confirmation of single mother status.

In the absence of the latter, the mother is not recognized as single and additional information about the father and confirmation that he did not receive this financial assistance are required.

Employed mother

The status is verified by a certificate issued for the child, where there is no information in the “father” column. If the father is not involved in parenting due to divorce, supporting information will be required.

This package of documents is transferred to the employer, who is obliged, after the expiration of the sick leave (maternity leave), to transfer to the employee the specified amount corresponding to the amount of the benefit for a single mother.

Stay-at-home mother

A non-working mother or student carries out registration through the Social Insurance Fund in accordance with the place of registration of the newborn. The same papers are needed, and in addition a copy of the ore document, because information about the date of dismissal and place of work is required. The application includes the following fields to fill out:

- applicant data: personal, passport, registration;

- marital status;

- characteristics of the newborn;

- information about other minor children;

- date of dismissal and place of work.

The standard procedure involves transferring to an employee of the social security agency. protection of an application from the mother or other person (guardian) with a package of documents. After 10 days, during which the application is considered, payments are assigned in favor of the mother.

Payments for child care

In 2017, child benefits are accrued to single mothers after the birth of the baby and up to 1.5 years. Registration takes place through the following institutions, according to the category of the mother:

- a company where a woman works;

- University, technical school or other institution where the mother is studying;

- Through the social security authority, if the woman is unemployed.

- The package of documents contains complete information:

- Applicant's passport.

- Certificate of registration of the child from the registry office.

- Similar certificates for all children, including adopted ones.

- Other confirmation of the status of a single mother, if this information is not contained in the child’s certificate.

- Certificate of completion of a full-time course. Provided by the institution itself if the applicant is a student.

- Information about the previous employer, if the woman is not currently performing work duties.

Amount of monthly benefit

The minimum amount of state assistance for a single mother in 2017 is provided for unemployed women, these include students and workers whose enterprises were liquidated while they were on sick leave during childbirth. It is about 2.9 thousand rubles. If the newborn is not the first child in the family, the amount increases to 5.8 thousand rubles. The mother receives this amount once a month after approval from the Social Insurance Fund and until the baby is one and a half years old.

The monthly benefit for a single mother in 2017 will be many times greater if she is officially employed. In this case, the size calculation is individual according to her income. Thus, the average level of profit is determined, which includes all receipts to the employee’s account for two years, including compensation and bonuses. 40% is calculated from the average parameter. This is exactly the amount a working woman is entitled to for caring for a newborn.

A prerequisite is that she is on vacation based on a pre-submitted application. The order for it must indicate the reason - providing care for a child under 1.5 years old. They begin to transfer money to the employee’s account upon completion of sick leave for childbirth. The subsidy is limited in the area of maximum size - up to 21,554 thousand rubles.

Force majeure situations and their solutions

While on vacation and receiving child benefits, an unforeseen situation may occur, for example, the liquidation of a company. In this case, you should not worry, but act in this order:

- Obtain from the employer a copy of the order on leave to provide care for the baby.

- Request a certificate from the employer indicating the dates and amounts of transfers of this type of assistance.

- Prepare a certificate of the child, other children (if any) and a work book.

- Visit the defense authority (FSS), fill out an application and submit the papers.

- Wait for approval.

- Receive payments from this body in the previously calculated amount (40% of the salary).

Additional benefits and opportunities for single mothers

In addition to general conditions and benefits, single mothers may receive additional ones, if provided for in a particular region. Local governments formulate their own budgets and have the opportunity to increase some expenditure items. Likewise, the benefit for a single mother in 2017 may differ significantly in the regions. In some, they can be paid for a longer period - up to 3 years (instead of one and a half), up to 6, or until adulthood. In some areas there are programs to help unemployed single mothers. Benefits are provided for children reaching 14, 16 or 18 years of age. They can range from 150 to 1500 rubles in various areas. These criteria should be clarified in advance with the relevant structures.

Non-material benefits

In addition to monetary assistance, a single mother receives additional guarantees for her child:

- Registration for preschool institutions without the need for prior registration (no queue).

- Free meals at school (two meals a day).

- Providing school and office supplies free of charge.

A working single mother also has a number of privileges:

- An employer cannot fire an employee in this category. The only reason can be the liquidation of the company. But even in such a situation, he is obliged to provide assistance in finding employment. The rule applies until children reach 14 years of age.

- Sick leave for an employee necessary to care for a sick baby is paid at 100% of the salary.

- It is unacceptable to send an employee on a business trip (only with her written consent).

- She is not supposed to be assigned night shift.

Different situations require different design of benefits for single mothers, and the amounts of payments also vary depending on the mother’s employment.

Latest site materials

Experience

Sundress for a doll Monster High School of Monsters How to sew a sundress for a doll

Natalya Popovich Moral education is one of the sections of all educational programs. Both in kindergartens and schools they study in detail the country in which you live and your city. Of particular importance is the education of patriotic feelings: love for

Cooking

Benefits and guarantees for single mothers

At the federal level, child benefits for a single mother are practically no different from payments for children raised in a two-parent family - neither in the list of types, nor in their size. Special benefits that could take into account and improve financial status

Health

The most beautiful underwear in the world

Children's underwear is a very important component of the wardrobe. Thanks to him, the child and his body develop properly. And from the point of view of taste, the influence of what a child wears shapes a sense of style in the future, this is especially important for a girl. Good model

Cosmetology

Research work “Stones and minerals of the Perm region”

Project participants: Implementation: teacher Popovtseva O.V., music director Palekhova O.V. Target group: pupils of the preparatory school group, parents of pupils. Project scale: In terms of implementation time - short-term (6 months)

Cooking

Original do-it-yourself gift wrapping Beautiful do-it-yourself New Year's gift wrapping

The holiday is just around the corner, so we offer you gift wrapping ideas for the New Year 2019. Every year, the design of a New Year's surprise is not the least important. Individuality can emphasize the value of a present. And it’s more pleasant to receive a surprise in a different place.

Cosmetology

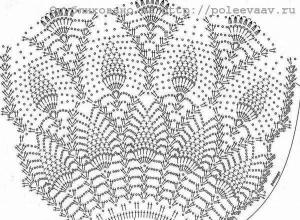

How to knit a beautiful children's sundress for a girl with crochet and knitting needles: instructions for beginners

We offer you a very delicate and airy lace outfit for your little princess. Attention! Only partial quotation is possible with obligatory reference to. Crocheted sundress for girls Prepare: 150 g of Vita cotton Lira yarn, color - milky, 40 g of yarn